How IOT and data analytics plays a crucial role in finance sector?

The definition of IoT and Data analytics within financial services

The Internet of Things (IoT) is thriving and there are astounding statistics that indicate that it is no less than a “third industrial revolution.” The scenario immediately reflects the dramatic effects of IoT on various industries such as retail, manufacturing, transportation, and energy, and surprisingly, financial services hardly come to people’s mind. As the governing IoT involves transfer of data, and the financial sector is largely dependent upon collecting and analyzing data, it’s difficult not to envisage IoT affecting the financial services industry.

In fact, financial services industry has experienced unparalleled transformation in the recent years and customers now claim a more personalized service from their banks. As per the EMC-sponsored IDC Digital Universe study, the world’s data is getting doubled in every two years and has already reached 1.8 trillion gigabytes by 2011. The underlying challenge during these times is to intelligently use the data and meet the needs of demanding customers by proposing relevant solutions and services with the use of data analytics.

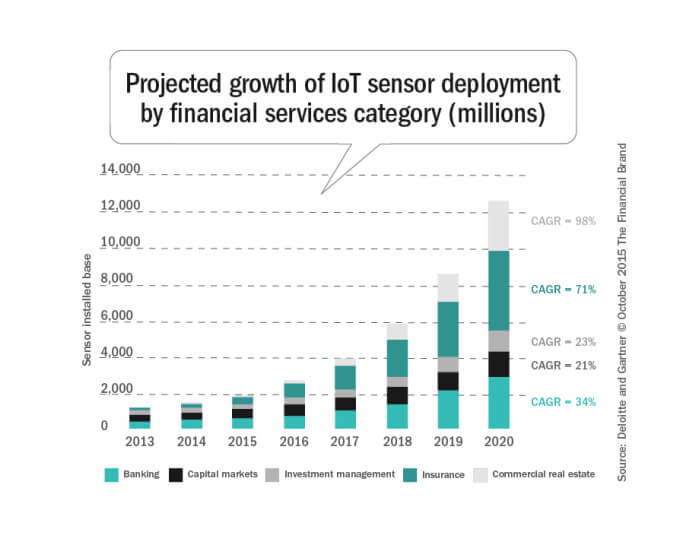

Estimated growth of IoT sensor deployment by financial services category

As predicted by Gartner “endpoints of the Internet of Things will grow at a 32.5% CAGR from 2013 to 2020, reaching an installed base of 25.0 billion units” worldwide. This clearly indicates that with the deployment of 25 billion new endpoints, new set of opportunities will emerge for all industries, such as finance and banking. On the whole, the growth in sensor deployments is likely to be massive, with a growth rate ranging from just 20% to 100% at an annual rate as per the sector.

Key trends redesigning the financial services industry

If you look at the overall market, there are certain key trends that you are likely to witness in the financial services industry in 2017. The 2016 Wells Fargo account scandal has indicated how much vulnerable financial service industry is. With huge penalties and sanctions, it has become increasingly important for banks to have strong monitoring in place in order to curb possible financial crimes and at the same time redesign their products and services to satiate the needs of customers seeking personalized attention. The year 2017 will herald more opportunities to influence productivity at business using big data analytics.

How IoT and Data Analytics Transforming Banking and Financial Industry

IOT is getting everybody enthusiastic about future. It is all about connected technologies and objects that can transform our lives and the business in a significant way. Here are some of them:

- Better products and service models

Faced by scrutiny and higher customer expectations, various financial service sectors are coming up with better products. Companies are now taking a fresh approach to products or services they offer by using the power of internet connected devices. For example, the insurance company Neos is allowing potential customers to identify the threats to the home including floods, theft or fire– in real time. The user can just tap on the app and check up on their home and if something goes wrong, they will be immediately alerted.

- Data revolution

IoT has provided an opportunity to financial service providers to consolidate their relationships with the customers. For example, if used creatively, the data collected and investigated through the IoT can help an insurance company a thorough understand a customer’s risk profile and thus devise better marketing campaigns and propose accurate pricing. However, at the same time, this requires safe and secure handling of confidential information.

- Better insight

There is a huge opportunity for the financial sector to harness the potential in the data using analytics and formulate a business strategy using realistic data rather than depending upon instinct. If explored well, the data provided can help companies understand customers and competitors better and come up with engaging business strategies to deal with the challenges.

- Better decision making

The organizations are under tremendous pressure to enhance the integrity of the data, and it has become important for financial institutions to get access to improved data quality analytics in order to make better decisions for commercial benefit.