Accelerate Underwriting, Fast-Track Claims using AI

Insurance underwriting services are offered by large institutions such as banks, investment and insurance houses to cover the financial risks that might arise due to financial losses or in case of damages suffered by clients. The services are provided only after evaluating the threats and exposures which the potential clients are subjected to. The underwriters are actively involved in estimating the client coverage, the cost they are supposed to pay and if they are liable to the insurance. Underwriting is applicable to industries such as Auto Insurance, Property Insurance such as HomeOwners Insurance, Commercial Insurance, Renters Insurance, Pet Insurance, Life Insurance etc., This business is a tell-tale example of how a single human error can mislead the entire process. Keeping up with the policy changes, rescissions, managing the time and workflow and tougher predictability are some of the challenges clients have to face on a regular basis. What more could be the right solutions for all these bottlenecks other than Artificial Intelligence(AI)?

The capability of AI extends to predicting the rate of accidents and similar unpleasant incidents in daily life. Imagine a bot telling you that if you choose a particular route, you might get into an accident. When you bump your vehicle into a parking sign, it would calculate the extent of the damage. It would scan your vehicle and inform you about the mobility insurance premium options available for your vehicle. Yes! That’s going to be the impact of AI on insurance in 2030, as predicted by Mckinsey.

We all are familiar with AI in our everyday lives. Some of the jaw-dropping advances in recent years have come from artificial intelligence(AI). In underwriting, AI can update analysis side-by-side as new data becomes available and optimize risk management insights to create more accurate recommendations. With the advent of on-premise and cloud technology, the data can also be stored under a single roof without involving any risks. The only constraint involving cloud technology is that data storage becomes less secured while we move on to third-party vendors. Hence it is a must to choose a reliable, experienced third-party vendor to store your client data. This way, data access becomes simpler, secured, and quick.

When the advances made in the field of persuasive technology are bundled with the insurance products, the proposition for applicants to share their data can be matched with insurers offering financial incentives (e.g. premium reduction, cash back) to those reaching the clinical outcomes set in the disease management program. Risk analysis, if done manually might pave way for more errors. It might turn more time consuming and mind-numbing in due course. The promising AI devices can be used to examine the plethora of medical and non-medical data and update risk calculations as soon as possible providing more accurate underwriting outcomes for the insurer and recommending healthier behaviors among those who are insured.

In the small and medium enterprise (SME) insurance market where the premium is typically low, AI can be used to improvise decision making, similar to the present condition in personal loan underwriting, where it becomes quite easy for an applicant to make a decision.

When AI is brought into action for risk selection and pricing, insurers can alter the underwriting flow and advance their methods for experience and engagement of the customer.

To overcome the challenges faced by underwriters, it is vital that they make use of an effective AI system which can serve them as a supporting hand. In underwriting and service management, there are various use cases for which insurers could rely on AI powered technologies. These include –

- – Insights extraction from different information sources

- – Automated demand analysis and generation of new product offerings

- – Improved pricing and policy rating and personalization

- – Interacting with employees in a natural language

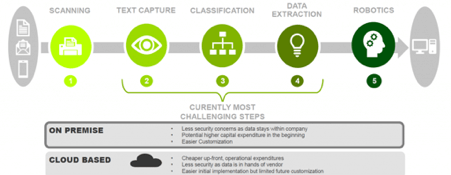

In the following use case, a solution can be designed for a completely programmed underwriting process comprising of different steps that include: solving major challenges in structuring, extract and analyze unstructured data.

Use case: End-to-end automation of business processes from an unstructured data input

It can be observed from the above diagram that everything in the journey from data input to output can be robotized using a particular set of AI-boosted technologies. This doesn’t mean that humans have been sidelined in this journey as the workforce will likely need support to become trainers, explainers and sustainers.

As AI spreads across the insurance sector, raising and training intelligent machines to function efficiently and accurately will become a defining role and a significant creator of jobs at different skill levels.

FAST-TRACK CLAIMS USING ARTIFICIAL INTELLIGENCE (AI)

The insurance industry has become a natural use case for artificial intelligenceand cognitive technologies looking at thousands of claims, customer queries and large amounts of diverse data. AI is often seen as an innovative effort in the insurance sector from customer service to claims processing.

Identifying the current threats

Traditional modes of process handling in the insurance sector have given rise to adverse problems like:

- – Handling of claims

- – Detecting fraud

- – Problems in pricing

All the above mentioned critical issues can be rectified with the help of AI-assisted solutions around AI based Claims Management Process. Insurance industry processes are time-consuming jobs considering the data types that are usually used including claim form input, incident documentation, medical reports, and repair. But, thanks to AI as it provides the insurers with the opportunity to deal with a massive amount of data producing the following positive effects:

- – Automated claims handling and fast-track claims processing

- – Reduced processing time and efficient and lean underwriting processes

– Improved hit and retention ratios leading to higher customer lifetime value

– Increased risk evaluation and options to mitigate risk and fraud

These benefits will enable insurers to deliver more projects in less time.

- Fraud Detection – There might be some cases where the insurance representatives have to deal with fraudulent cases while handling claims. With AI-assisted systems, specific data patterns can be identified to detect fraudulent claims. Machine Learning(ML) or deep learning can be used to detect fraudulent issues and recognize repair costs.

- Customer experience and marketing – It is now known that insurance services are essential parts of the service sector. Customer experience and consumer interactions are of utmost significance and maintaining a good relation and brand reputation during the claim process is key for increased life time value. With the help of AI systems and technologies selected consumer profiles can be identified thus designing customized insurance strategies for them.

- Secure access of Confidential Data – Ability to access relevant information without seeing all data around customers. This is big when the agent only wants to know only certain information such as if the customer is receiving appropriate insurance coverage or not to guide them to relevant workflow or processes or next steps.

- Customized Insurance Product – With the help of AI systems and technologies selected consumer profiles personas and help them provide or design customized insurance strategies for them upon the claim has been processed based on the risk level.

- Elevate Customer Experience and Personalized Marketing -Utilize AI to improve consumer engagement and experience. Artificial Intelligence can be used across different mechanisms including discovering customer’s feedback about their products and services to improve the overall customer experience.

- Improve Customer Engagement – Chatbots incorporated with natural language processing(NLP) and sentiment analysis has the capability to understand the customer’s respective language to improve the effectiveness. Intelligent chatbots allow users to interact with the company through natural conversations. With ongoing advancements in technology, they are substituting human assistants to produce fast and efficient customer service which is available 24/7. This is especially important when it comes to filing a claim which could happen at any point of time. Less time and efficient process is the key for this customer engaged claim process.

Nowadays, AI has been creating a spotlight for itself in various fields. Let it be business or a sport or insurance, AI has been found to possess various applications in almost all the areas of our life. Hence with accelerated underwriting using artificial intelligence(AI), insurance companies are ensured to have a leading edge against their competition and increase brand reputation, customer engagement.